Original manuscript by A. Michael Rupured, Retired Extension Consumer Economics Specialist

Reviewing credit reports is time consuming, and in the business world, time is money. Instead of analyzing your credit report to make a decision about whether or not you are a good credit risk, lenders will most likely look at your credit score. The credit score boils all the information in your credit report down to a three-digit number between 350 and 850 — anything over 720 is considered above average.

This number, your credit score, is based on complex equations utilizing mountains of data collected and analyzed over the years about the bill paying behavior of consumers. Like it or not, the credit score is a remarkably reliable predictor of who is and is not a good risk for a loan. The lower your credit score, the higher the risk and the more you will pay in finance charges for credit. The higher your score, the better you look to lenders.

To determine if your credit score is above average, compare your credit history with that of the average consumer. According to the Fair Isaacs Corporation, developer of the FICO credit score, the average consumer:

- Has 11 credit obligations.

- Carries less than $5,000 in debt, excluding mortgages. Among those that carry a balance, about half (48 percent) carry a balance of less than $1,000. Nearly 30 percent carry more than $10,000 of non-mortgage debt.

- Has access to $12,190 in available credit from all credit cards combined. More than half of all people with credit cards are using less than 30 percent of their total credit limit. Only about 1 in 8 uses 80 percent or more of their credit card limit.

- Has had a credit account that they have had for at least 13 years. One in five has a credit history longer than 20 years.

- Has had only one new credit inquiry within the past year. Fewer than 7 percent had four or more new credit inquiries in the past year.

- Has a near-perfect repayment history. Less than 40 percent show a payment more than 30 days past due, about 20 percent show a payment more than 60 days past due, and only 15 percent show payments more than 90 days past due. Less than 10 percent show accounts closed by lenders due to default.

The information in your credit report does not change much from month to month, unless you do something different or something happens. Your credit score may vary by a few points with each new month and with any changes in the factors that make up the score.

Factors that Influence Your Credit Score

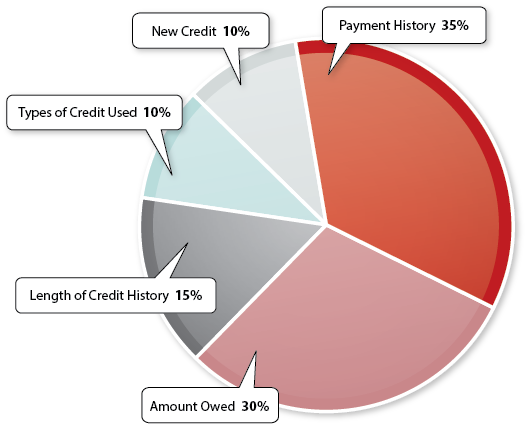

The exact formulas used to calculate credit scores, aside from being extremely complex, are proprietary. While we may not know exactly how the score is determined, we do know the relative weights of the five areas examined.

Payment History

The biggest piece of the credit score pie is your repayment history, accounting for 35 percent. That's why paying bills on time is the single-most important thing you can do to improve your credit score. When you start falling behind, credit scores fall fast. The difference between 30 days or more late and the next category (60 days or more) is significant, with 90 days or more being even more damaging to your credit score. Similarly, when you are starting over to improve your score, every month you pay your debts on time improves your score. The longer your track record of making payments on time the better. That's one reason why it pays to contact creditors at least once a year to ask about interest rate reductions or other concessions.

Amount Owed

The second biggest slice of the pie (30 percent) relates to the amount you owe and how much of your available credit you are using. Using lower percentages of your available credit will raise your score. Lowering credit limits and closing unused accounts may lower your score in the short run, but are good ideas that will likely improve your score in the future. Keep balances low on credit cards, pay off debt instead of moving it around, and avoid adding new debts or credit accounts.

Length of Credit History

The third factor, accounting for 15 percent of your credit score, is the length of time you have used credit based on the day your oldest account was opened. Avoid closing your oldest account to prevent reducing the length of your credit history. If you are just starting out, avoid opening too many accounts too quickly.

Types of Credit Used and New Credit

Each accounts for 10 percent of your score. All debts are not created equal. A 30-year fixed mortgage is a good debt. A debt consolidation loan from a finance company, on the other hand, is not. A lot of new debt will lower your score. Lenders like to see a nice balance including a home mortgage, a car payment, and no more than two or three credit cards with no sudden increases in borrowing. Scores calculated for other purposes may add or subtract points for other kinds of debt. When you do obtain new credit for an auto or mortgage loan, or from a lender that provides auto or mortgage loans, shop for it within 30 to 45 days so that the inquiries will count as one inquiry instead of many.

What You Need to Know

Your credit score determines whether or not you will be likely to receive a loan. Individuals with high credit scores qualify for loans with the lowest available interest rates. The fact that your credit score is high in no way guarantees that you will receive the best available credit terms. Different credit options can significantly increase the cost of the item to be financed. Consequently, it is just as important to shop for the credit as for the item you are financing. Read the entire agreement, especially the fine print, before you sign. If necessary, ask to take the contract or agreement home with you so you can look it over more carefully without an anxious lender standing over your shoulder. Keep a copy of the agreement and any disclosures on file. Watch for inserts in statements with information about changes to the original terms of the agreement.

Unfortunately, you usually have to pay one of the three major CRAs to find out your credit score. The score they provide may vary because your file at each CRA may not contain the same information. Whether or not it's worth the cost to find out your credit score depends on you, the situation you are currently in, and whether or not you have any plan or need for credit in the future. For example, if you are financially secure, own your own home, pay all your debts each month (and have for years), and have no plans to borrow for anything other than a car every few years, you probably don't need to know. Your score is likely high enough that you qualify for the best rates.

If you are just starting to build a credit history, or perhaps you are starting over again and trying to get beyond some of the problems of the past, it might be worth the cost. Knowing what you're dealing with can give you an idea of how much work is needed, how long that work might take to complete, and give you a tool for measuring your progress. The lower your score, the longer it's going to take to raise it to the 720+ level.

If you are about to buy a new house or plan to borrow for other purposes in the near future, knowing your credit score can help you to evaluate whether or not the rate you're being offered is appropriate for you. If you have a high credit score and are offered a high rate, you know you can probably get a better deal somewhere else. Finding out that your score is lower than expected might be sufficient reason to postpone the purchase long enough to address negatives and take other steps to improve your score.

Resources

For more information, contact your local UGA Extension office, visit www.gafamilies.org or call 1-800-ASK-UGA1.

Get your free credit report today: visit www.annualcreditreport.com or call 1-877-322-8228.

To get your second free copy, contact each CRA individually:

- Equifax: www.equifax.com, 1-800-685-1111

- Experian: www.experian.com, 1-888-397-3742

- TransUnion: www.transunion.com, 1-800-888-4213

Status and Revision History

Published with Full Review on May 13, 2014