Original manuscript by A. Michael Rupured, Retired Extension Consumer Economics Specialist

What do you do when someone asks to borrow money or a personal item from you? Your decision about whether or not to lend will likely be based upon your perception of that individual's character, his or her capacity to pay you back, any collateral offered in exchange, perhaps your knowledge of capital they hold in reserve, and conditions — the situation they are in and the cost to you. We call these factors the Five C's of credit.

The Five C's of Credit

- Character

- Capacity

- Collateral

- Capital

- Conditions

Lenders and other entities rely upon these same factors when making decisions about whether to do business with consumers and businesses. Instead of gut reactions and informal agreements, the world of credit relies upon formal agreements that are regulated by the federal government.

Federal law determines the information that can and cannot be used by lenders, employers, and others to make decisions about doing business with you. When you complete an application to apply for a loan, lenders cannot ask about your age, religion, race and other factors that have nothing to do with your ability to repay the loan. Credit Reporting Agencies (CRAs) collect information about you from financial institutions, court documents, public records, companies with which you do business, your employers and other entities. CRAs make money by charging for access to the information they have collected about you for a wide variety of purposes including to verify information you provide on job and credit applications.

The CRA file about you is your credit report. Your credit report documents the Five C's of credit as they relate to you and is the basis for your credit score. Understanding how your credit report is compiled and used is essential for your long term economic well-being and overall financial security. In a 2005 Government Accountability Office (GAO) survey, the average score on a knowledge test about credit reports and credit scores given to consumers was just 55 percent. Two-thirds of the respondents were unable to correctly name any of the major Credit Reporting Agencies (CRAs). An equal percentage did not know that credit histories could impact insurance premiums and possibly even employment. Nearly three-fourths (72%) did not know that CRAs investigate incorrect information on one's credit report for free. Lastly, more than half (52%) were not able to identify factors that affected credit, and nearly one-third (32%) did not know the definition of credit score.

Establishing, maintaining, and protecting Your Good Credit can save you thousands of dollars over time and may mean the difference between you and your competition for job opportunities. Federal law (FACTA) allows all consumers to obtain one free credit report every year from EACH of the three major CRAs (Equifax, Experian and TransUnion). You can request your first free copy from each CRA online (www.annualcreditreport.com) or toll free (1-877-322-8228).

Georgia residents are entitled to two additional free credit reports from each of the three major CRAs. To obtain your second or third free copy, you need to contact each CRA individually. When you use the Internet, they may ask for a credit card number before determining that you are a Georgia resident and eligible to receive a free copy. Providing a credit card number is not required when you call the toll free number for each CRA.

Tip: Obtain a copy of your credit report from all three CRAs before you apply for credit to finance a large purchase to ensure that the information in your report is accurate and complete. To review your credit report more often, rotate through the CRAs to obtain a free credit report from each one every other month for a total of six each year.

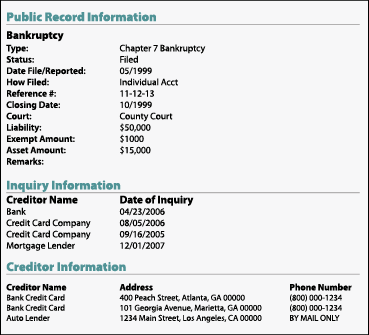

Negative information in your report that is accurate remains on the credit report for seven years; ten years in the case of Chapter 7 bankruptcy. Positive information may remain on your report indefinitely, but is often purged after seven years. Negative information may reappear at a later date if the obligation is still outstanding.

If your credit report contains inaccurate information, follow the instructions that came with the report for disputing errors. The CRA has 30 days to confirm receipt of your inquiry, and 60 days to investigate. You may need to contact the creditor reporting inaccurate information about you to clear up the problem. Once the problem has been resolved, wait two or three months and request a copy of your credit report to make sure the inaccurate information has been removed.

What's on Your Credit Report?

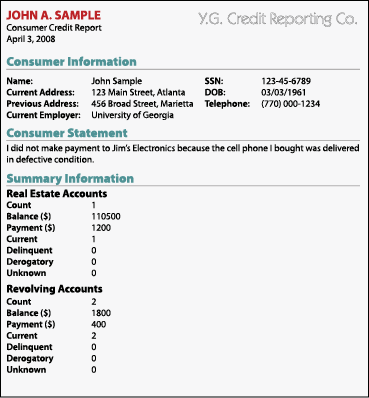

Personal Information including your name, current and previous addresses, current and previous employers, your Social Security Number, your telephone number, and your date of birth are on your report. Age cannot be used as a factor in employment or credit decisions. Your date of birth is collected in most cases to verify identity. Your credit report does NOT include gender, ethnicity, religion, political affiliation, medical history, criminal records or your credit score.

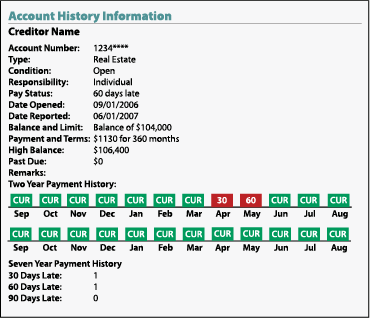

Credit History includes information about credit accounts that were opened in your name or accounts for which you are an authorized user. Accounts may include retail credit cards, loans from a financial institution or finance company, mortgages and home equity loans, and bank credit cards. It generally does NOT include information about your experience with checking or savings accounts. For each account, your credit file includes the creditor's name, your account number, how much you borrowed, how much you still owe, your credit limit, dates the accounts were opened, updated, or closed, and your repayment history. Repayment history categories include: paid as agreed, 30 days or more late, 60 days or more late, 90 days or more late, and closed by lender due to default.

Inquiries are recorded on your credit report any time someone requests access to your file. There are three types of inquiries. Consumer initiated inquiries are the result of your application for credit, employment, or service leading to a request from the business for your credit report so they can verify the information you provided on the application. There are also "Promotional Inquiries," such as when a credit card company is looking for consumers with a particular profile for marketing purposes, such as credit card offers. Finally, there are "Administrative and Account Management Inquiries" from businesses you owe money to in order to verify that your financial situation and ability to repay hasn't changed.

Public Records include tax liens, bankruptcies and court judgments. As noted above, criminal records are NOT part of your credit file. CRAs can and do create specific credit reports to meet the needs of the requesting entity. When you request a copy of your credit report from one of the three major CRAs (Equifax, TransUnion, and Experian), the copy you receive includes everything so you can verify the accuracy of the information and address any errors. Requesting entities may see all or part of that information, and in some cases, more. Information not included as part of your credit file, such as education verification, Department of Motor Vehicles record checks and criminal record checks, may be combined with the report by entities that specialize in background checks.

Resources

For more information, contact your local UGA Extension office, visit www.gafamilies.org or call 1-800-ASK-UGA1.

Get your free credit report today: visit www.annualcreditreport.com or call 1-877-322-8228.

To get your second free copy, contact each CRA individually:

- Equifax: www.equifax.com, 1-800-685-1111

- Experian: www.experian.com, 1-888-397-3742

- TransUnion: www.transunion.com, 1-800-888-4213

Status and Revision History

Published with Full Review on May 13, 2014