Introduction

Understanding the concept of basis is a key element in developing a sound marketing plan. Basis refers to the relationship between a commodity's cash price in a local market and its futures market price. A more formal definition of basis is the difference between the cash price and the futures price for the time, place and quality where delivery actually occurs. Even if a producer never uses the commodity futures market directly, knowledge of the basis can be of great value when making marketing decisions.

Commodity futures market price quotations reflect the collective opinion of thousands of traders concerning the overall supply and demand balance for a commodity. In today's world, futures markets reflect a market of global proportions. Commodity prices in Georgia are directly influenced by worldwide supply and demand factors reflected in the futures markets.

Georgia prices are heavily influenced by -- but seldom identical to -- the futures market prices on the Chicago Mercantile Exchange (CME). Local cash prices and futures market prices are usually positively correlated for a given commodity. So, when futures market prices rise, Georgia prices rise. Similarly, when futures market prices fall, Georgia prices fall. However, there is usually a difference between the local Georgia cash price and the price on the CME. The difference between Georgia cash prices and the futures market prices is called the basis. Basis reflects the supply and demand situation in the local Georgia market, and changes as local conditions change. Georgia buyers signal their eagerness or reluctance to purchase a commodity by bidding a higher or lower price for it. This eagerness or reluctance is communicated in the changing basis; in other words, comparing the local Georgia price relative to the futures market price.

Estimating the Basis

Basis is defined as the cash price minus the futures price (Basis = Cash Price - Futures Price). If the local price for 500- to 600-pound steers is $175.00/cwt. and the nearby futures contract is $180.00/cwt., then the basis is $175.00-$180.00 = -$5.00/cwt.

In general, reasonably accurate basis estimates can be obtained by selecting a day during the week to collect a cash and futures price quote and averaging this value over a three- to five-year period. Local cash livestock prices are available from state and federal market news services or farm organizations. Commercial vendors also provide price quotes for a fee. Current futures quotes can be obtained from most newspapers, radio stations and private vendors. A useful website for collecting basis information for Georgia auctions is www.beefbasis.com. Readers in southeastern states may also find the Southeast Cattle Advisor website (www.secattleadvisor.com) useful for obtaining local cash market and futures price information.

Interpreting the Basis

A basis of zero means futures market prices and local cash prices are the same. When the basis is not zero, local supply and demand factors are different from those prevailing in the futures market. The basis can be positive or negative. A negative basis indicates the local cash price is less than the futures market. When the basis is positive, the cash price is greater than the futures market price, which means the cash market is trading at a premium to the futures. As a result, the basis is preceded by a plus (+) or minus (-) sign representing a positive or negative basis, respectively. The basis must include the correct mathematical sign for correct interpretation.

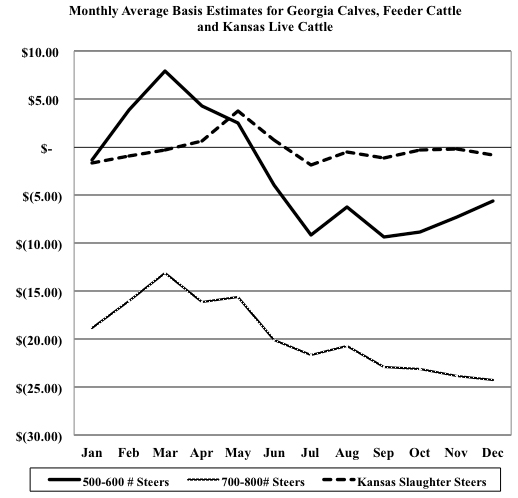

Basis tends to fluctuate because local supply and demand conditions continually change. Changes in the basis are known as basis patterns. To use basis to evaluate marketing alternatives, basis theory and associated concepts must be understood. Basis patterns are one of the fundamental means of evaluating marketing decisions. When the basis becomes more positive or less negative over time, it is said to narrow or strengthen. A "strengthening" or "improving" basis changes from "weak" (the cash price is low relative to the futures price, indicated by a wide difference (as in Figure 1)) to "strong" (the cash price is high relative to the futures price, indicated by a narrow difference (as in Figure 1)). In Figure 1, the 500- to 600-pound steer basis is weak during December at -$5.55. By March, the basis is strong, at +$7.91. The basis for feeder cattle (700-800 pounds) in Georgia is usually weakest during the fall and strengthens during the winter and early spring.

Figure 1. Monthly Average Basis Estimates for Georgia Calves, Feeder Cattle and Kansas Live Cattle, 2009-2013.

Figure 1. Monthly Average Basis Estimates for Georgia Calves, Feeder Cattle and Kansas Live Cattle, 2009-2013.Predictability of the Basis

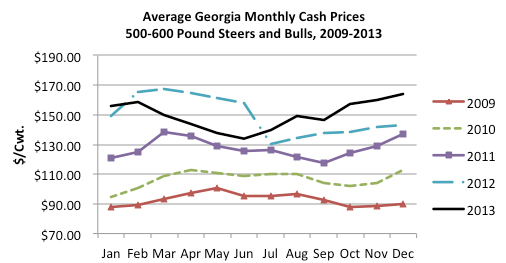

Although the basis varies throughout the year and from one year to the next, it tends to be more predictable and more stable than changes in cash prices of feeder cattle or live cattle. Figure 2 contains cash prices for feeder cattle by month in Georgia from 2009-2013. By looking at the chart, one can see the volatility of cash prices of steers during this time. Cash prices for 500- to 600-pound steers and bulls ranged from a low of $87.74/cwt. to a high of $167.51/cwt. By comparison, during the same period, the basis range was $31.75/cwt., from a strong point of +$15.01/cwt. to a weak point of -$16.74/cwt. This illustrates that basis is more stable than spot cash prices or futures prices. Other steer, heifer and slaughter cattle price examples would show similar results.

Figure 2. Average Monthly Cash Prices for Medium-Large Frame, Number 1-2 Muscle Score, 500-600 Steers in Georgia Auction Markets, 2009-2013

Figure 2. Average Monthly Cash Prices for Medium-Large Frame, Number 1-2 Muscle Score, 500-600 Steers in Georgia Auction Markets, 2009-2013Forecasting the Livestock Basis

Studies* have shown that using the recent three- or five-year average of the local basis (adjusted for quality differences) provides as accurate a forecast of the basis as more sophisticated forecast techniques. The important information from historical basis studies is the variability in the cash/futures difference. If, in June, the difference between 500- to 600-pound steers sold locally and the futures price has averaged -$3.92/cwt. during the last five years but has varied from $11.74/cwt. below to $2.42/cwt. above futures prices, it may be expected that local 500- to 600-pound steers will bring $3.92/cwt. less than the January futures price. However, there is some chance of receiving a price as much as $11.74/cwt. less than the current futures price, or $2.42/cwt. more than the corresponding futures contract price.

*Taylor, M.R., K.C. Dhuyvetter, and T.L. Kastens. 2006. Forecasting Crop Basis Using Historical Averages Supplemented with Current Market Information. Journal of Agricultural and Resource Economics 31(3):549-567.

Historical basis information would normally be summarized in a table such as Table 1, which displays the average basis for the time period and the variability (standard deviation) of the basis. Approximately two-thirds of the basis' experienced over the given time period were within the range of the average basis plus or minus the standard deviation.

Livestock Basis Patterns

Feeder and live cattle basis are not constant throughout the year. The seasonal basis pattern for 500- to 600-pound steers, 700- to 800-pound steers and live cattle is shown in Figure 1. Most of the seasonal pattern is due to production differences, which impact marketing patterns. For instance, most of the U.S. beef cow herd is on a spring calving system. As a result, supplies of weaned calves are greatest in the fall. When these calves are placed in feedlots, they are typically ready for slaughter in mid- to late summer.

Due to seasonal supply variations, the feeder cattle basis is strongest in the spring (when the least number of calves and feeder cattle are available) and weakest in the fall and early winter (when there are larger numbers of cattle). On the other hand, live cattle basis is relatively strong in late spring and early summer before falling into the weakest basis period around July.

Factors Affecting Basis for Feeder Cattle and Calves

In general, three factors determine Georgia's livestock basis: time, location and quality. The time dimension of the basis is usually limited to the time the livestock are expected to be delivered on the local cash market and the nearby futures contract. As the nearby futures contract approaches expiration, the local cash prices and futures prices should converge and differ by only a small amount. Thus, as the feeder futures contract approaches expiration, the basis difference reflects only location and/or quality differences. Because livestock are not storable, basis differences in months other than the nearby month will also reflect the general direction of expected movements in prices.

In addition to location and time, quality can make a major difference in basis. Variations from the specification of the underlying futures contract can make the basis wider or narrower. Examples of quality differences include heifers instead of steers, lighter or heavier weights and frame size or muscle scores different from those specified by the underlying contract.

In addition to location and time, quality can make a major difference in basis. Variations from the specification of the underlying futures contract can make the basis wider or narrower. Examples of quality differences include heifers instead of steers, lighter or heavier weights and frame size or muscle scores different from those specified by the underlying contract.For example, the difference between the cash price of feeder cattle in February (for which there is no futures contract) and the March futures contract will depend on the futures market anticipation of the supply of and demand for feeder cattle in March as compared to the actual supply and demand in February. If the market expects an increase in feeder cattle supplies from February to March (and thus a lower feeder price in March), the March futures price could be lower than the February cash price. This would result in a positive February basis (with the February cash price higher than the nearby March futures). The opposite situation could result in a negative basis (with a cash price lower than futures). As the cash-marketing time approaches the futures contract expiration, the basis becomes more predictable because the market direction is not considered. Note the large "probable ranges" for the deferred or "non-expiration" feeder cattle contract months in Table 1.

Location differences in basis may also exist. Anything affecting the local supply and demand balance relative to the futures market delivery point also affects the basis. For instance, a severe local drought or other weather situation may have little impact on the national demand for feeder cattle, which determines the futures price, but can have a great impact on the price received locally. Delays in local markets due to field work demands in the spring or inclement weather in the winter can also affect the basis, because local buyers may be willing to pay more relative to the national market price due to a reduced local supply.

Transportation cost is also a major determinant in the basis; therefore, any item that increases transportation costs will widen/weaken the basis. For instance, increases in fuel costs will result in Georgia cash prices being relatively lower than other regions in the country closer to feedlots. Also, sometimes in years when the U.S. produces an exceptionally large grain crop, limited availability of semi-tractors due to grain transportation will decrease feeder cattle prices in Georgia relative to futures prices. Transportation costs of moving feeder cattle from Georgia to feedlot states are the primary reason for a large negative feeder cattle basis in Georgia.

Because live cattle futures are based on live weight, cattlemen who are marketing on a carcass-weight basis should convert base (par) cash prices and any premiums or discounts back to a live-weight basis to ensure they are comparing apples to apples.

The formula for this conversion is:

Cash Price = [Net Carcass Price] X Dressing Percentage

For instance, if the base carcass price is $220/cwt. and a producer expects net premiums of $5 with a dressing percentage of 64%, his cash-equivalent price is {$220+$5} X .64 = $144/cwt. If the nearby live cattle futures is $140, the producer has an expected basis of +$4/cwt. on a live-weight basis.

Quality is another determinant of basis. The futures market price is set for a specific quality. The basis estimate should reflect any anticipated discount or premium due to local delivery of a differing quality of livestock. For instance, the feeder cattle futures contract specifies medium and large frame number 1 and number 2 muscled steers weighing 650-849 pounds. Cattle that are different from this specification will receive either premiums or discounts. This is why heifers have a wider basis than steers. Alternatively, producers marketing truck-load lots of cattle will have a better basis than those presented in this publication because those cattle typically receive premiums**. Normally, the use of the current discount, or premium, quality difference will provide an adequate forecast of the quality component of the basis.

Approximately 80 percent of Georgia calves and feeder cattle are sold in lots of three head or fewer. These cattle typically are discounted $8.00-$12.00 per hundredweight compared to semi-tractor load lots.

Factors Affecting Basis for Live or Slaughter Cattle

Much of the discussion above, namely local supply and demand as well as transportation costs, can be directly applied to live cattle. However, because slaughter cattle can be marketed on either a live-weight or carcass-weight basis, cattlemen must know how these quality differences impact their basis.

The live (slaughter) cattle futures contract specifies cattle or carcasses that are 55 percent Choice / 45 percent Select Yield Grade 3 or better. Thus, producers who are marketing cattle with carcasses different from this mixture should adjust their expected basis accordingly. For instance, if a cattleman historically produces 75 percent Choice carcasses that are Yield Grade 3 or better, he would have a narrower/ stronger basis, while cattlemen who historically have a higher percentage of Select or Yield Grade 4 carcasses would have a wider/weaker basis. Finally, producers who are receiving premiums for branded or source-verified programs may have a more favorable basis and will need to adjust their estimates accordingly.

Using the Livestock Basis to Increase Profits

Knowledge of livestock basis can help producers in three ways: 1) evaluation of hedging or floor pricing opportunities, 2) evaluation of cash contract opportunities and 3) cash market timing. By properly estimating the basis for the quality and location of the livestock to be delivered, Georgia producers can use either the futures market or the commodity options market to forward price cattle (see UGA Extension bulletins 1404 and 1405). If the basis is underestimated, producers may fail to take advantage of potential profit opportunities. Likewise, producers may find forward prices, initiated at what were thought to be profitable prices, result in losses due to an overestimation of the basis.

Producers who wish to forward price cattle and have forward cash contracts available need an understanding of the basis to evaluate their marketing alternatives. Typically, cash contracts are offered at basis levels less than the historical basis, because the contractor is assuming or taking on the risk associated with guaranteeing the basis and the cost of hedging in the futures or options markets. In order to determine whether the contract is a "good deal" compared to forward pricing directly in the futures or options markets, the difference in the contract's basis and the estimated basis should be considered. If the difference is large enough, the producer may find it advantageous to do the forward pricing himself.

For instance, let's say a producer is offered a forward cash contract to deliver a truckload lot of feeder steers at $180/ cwt. in April. If the April feeder cattle futures contract on this day is $185/cwt., the contract's implied basis is -$5.00/ cwt. If the producer's historical basis difference has been -$1.00/cwt., the producer has to decide if the $4.00/cwt. difference justifies contracting, because he could forward price by trading the feeder cattle futures contract himself (hedging). If he chooses to hedge himself, then he will take the risk that the basis turns out to be worse than normal. However, he would not lose money compared to the contact unless the basis was worse than -$5.00/cwt.

The basis may also be used to help producers decide when to move their livestock. If the basis is stronger than normal, livestock may be marketed slightly ahead of their estimated market period to take advantage of the favorable basis. Alternatively, a weak basis may be a signal to delay marketings if possible, with the idea that the basis is likely to return to a more normal level. In either case, the cost of gain relative to the value of gain as well as the basis movement must be considered.

Summary

An understanding of basis and the adaptation of marketing strategies that use that knowledge can increase receipts from commodity sales in Georgia. Basis data should be maintained and followed as a standard practice by Georgia farmers. The time spent following the basis and using basis patterns as a guide to marketing decisions can help producers earn a more favorable return.

Table 1. Georgia Feeder Cattle Basis Comparisons for Medium-Large Frame Number 1 Number 2 Muscle Steers; 500-600 Pounds, 2009-2013.

| Month | Average Basis | Standard Deviation | Highest Monthly Basis | Lowest Monthly Basis |

| January* | ($1.37) | $5.40 | $7.69 | ($6.68) |

| February | $3.85 | $8.02 | $15.01 | ($3.59) |

| March* | $7.91 | $5.11 | $13.28 | $1.13 |

| April* | $4.26 | $6.32 | $14.96 | ($0.60) |

| May* | $2.56 | $3.73 | $9.09 | $0.23 |

| June | ($3.92) | $5.18 | $2.42 | ($11.74) |

| July | ($9.15) | $3.39 | ($3.98) | ($12.09) |

| August* | ($6.20) | $3.58 | ($3.37) | ($12.18) |

| September* | ($9.36) | $4.73 | ($5.05) | ($16.74) |

| October* | ($8.79) | $3.70 | ($5.85) | ($15.16) |

| November* | ($7.28) | $4.74 | ($3.48) | ($14.52) |

| December | ($5.55) | $2.48 | ($2.04) | ($7.59) |

| *Denotes futures contract month. | ||||

Table 2. Average Monthly Basis Values by Weight Class for Georgia Steers and Heifers, 2009-2013.

| Steers | Heifers | ||||||

| Month | 400-500 | 500-600 | 600-700 | 700-800 | 400-500 | 500-600 | 600-700 |

| January | $13.20 | $(1.37) | $(12.43) | $(18.83) | $(6.23) | $(14.78) | $(21.86) |

| February | $18.21 | $3.85 | $(7.94) | $(16.06) | $(2.42) | $(11.51) | $(19.23) |

| March | $20.97 | $7.91 | $(4.44) | $(13.07) | $2.57 | $(6.95) | $(16.21) |

| April | $16.28 | $4.26 | $(6.37) | $(16.14) | $0.88 | $(8.04) | $(17.59) |

| May | $12.84 | $2.56 | $(7.04) | $(15.60) | $0.17 | $(7.48) | $(18.87) |

| June | $5.34 | $(3.92) | $(12.07) | $(20.10) | $(6.53) | $(13.42) | $(22.57) |

| July | $(0.06) | $(9.15) | $(14.74) | $(21.61) | $(14.99) | $(16.72) | $(23.47) |

| August | $4.11 | $(6.20) | $(12.24) | $(20.72) | $(8.99) | $(15.47) | $(21.52) |

| September | $2.82 | $(9.36) | $(15.83) | $(22.89) | $(13.19) | $(20.37) | $(25.55) |

| October | $5.38 | $(8.79) | $(16.92) | $(23.08) | $(12.49) | $(22.10) | $(27.36) |

| November | $8.09 | $(7.28) | $(16.07) | $(23.83) | $(10.96) | $(20.62) | $(26.91) |

| December | $10.75 | $(5.55) | $(16.36) | $(24.20) | $(9.56) | $(19.50) | $(27.13) |

Status and Revision History

Published on Jun 17, 2014