Main Takeaways

- Cotton prices are anticipated to stay low in 2025, driven by sluggish global economic growth, declining consumer demand, and rising trade uncertainty.

- U.S. cotton acreage and production are likely to remain at current low levels in 2025 because of relatively weaker price expectations compared to competing crops.

- Cotton production in 2025 is expected to face limited opportunities for profitability recovery, constrained by high input costs and low prices.

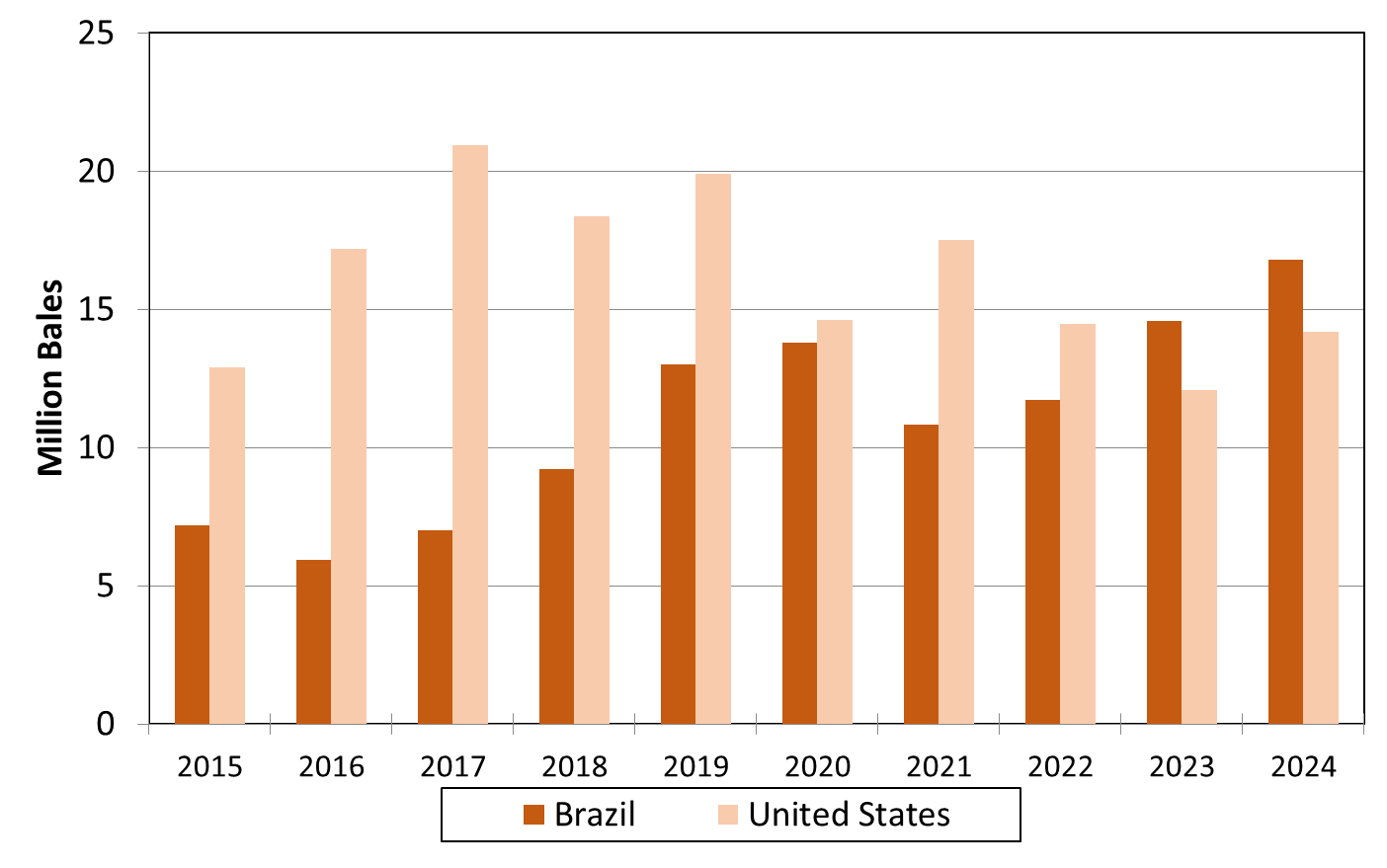

Cotton farming is a complex business, and growers have faced significant financial challenges over the years. In particular, 2024 proved to be a difficult year for cotton producers, marked by high input costs and low cotton prices, which left many struggling with negative profit margins. In 2024, low cotton prices were influenced by sluggish economic growth and typical fluctuations in supply and demand. Slower global economic expansion reduced cotton demand, leading to lower prices worldwide. Additionally, U.S. cotton faced heightened competition from Brazilian cotton production, which offers comparable quality at a lower cost, further pressuring U.S. cotton prices.

Economic Slowdown and Reduction in Cotton Demand Globally

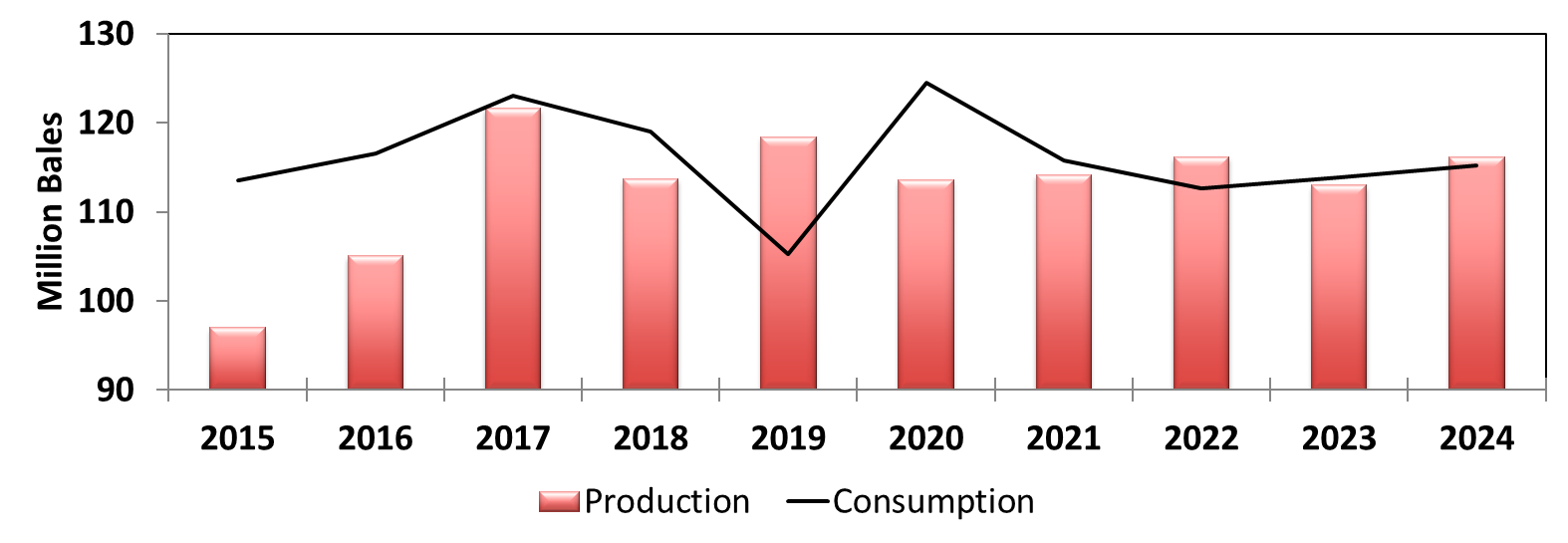

The International Monetary Fund's World Economic Outlook report from October 2024 highlighted stable yet underwhelming global growth, with risks skewed to the downside. Global economic growth is projected to decelerate to 3.2% in 2025. Global cotton demand has remained relatively low for several years following the last postpandemic boom in 2020 (Figure 1). The anticipated slowdown in economic activity in 2025 is likely to continue dampening consumer demand for discretionary items such as textiles and apparel, putting additional downward pressure on cotton prices.

Global cotton production in 2024 is projected at 117.4 million bales, exceeding world cotton mill use, estimated at 115.8 million bales. This reduced demand has contributed to an increase in global ending stocks, now projected at 76 million bales, further adding to the cotton supply.

Cotton Supply and Demand

In 2024, U.S. farmers planted 11 million acres of upland cotton and are expected to harvest 8.4 million acres, producing a total of 13.7 million bales. The national average yield is projected at 782 lb per acre, significantly below the 5-year average of 863 lb per acre.

The U.S. cotton demand for 2024 is estimated at 13.1 million bales, marking the second-lowest level in the past decade. U.S. ending stocks are projected to increase from 3.2 million bales in 2023 to 4.4 million bales in 2024, accompanied by a rise in the stock-to-use ratio to 33.6%. This marks the second-highest stock-to-use ratio in the past decade, the highest being in 2019 when the global pandemic significantly disrupted the market. These figures indicate an oversupply of cotton in the U.S., which has put downward pressure on cotton prices in 2024.

Interest Rate and Increasing Global Competition

After 4 years of maintaining historically high interest rates to combat inflation, the Federal Reserve began easing monetary policy in late 2024. The Fed is expected to continue cutting rates while maintaining its 2% inflation target, though it may take time for rates to reach lower levels. Federal Open Market Committee policymakers project that the federal funds effective rate will likely end between 3% and 4% in 2025.

U.S. cotton is facing heightened global competition, particularly from Brazil. Over the past decade, Brazil has significantly increased its cotton production, offering relatively high-quality cotton at lower costs compared to the United States. In 2023, Brazil surpassed the United States to become the world’s third-largest cotton producer, following China and India, and its production levels continued to rise in 2024 (Figure 2). This intensified competition in the global market poses ongoing challenges for U.S. cotton prices and profitability, making it increasingly difficult for American cotton farmers to maintain a competitive edge.

The rising trade uncertainty will place a significant high-risk factor on the already sluggish cotton market in 2025. Cotton markets are highly sensitive to trade policies because of their reliance on export demand, with the United States being one of the largest exporters globally. Shifts in trade agreements, tariffs, or international relations can introduce volatility and reduce market confidence, further suppressing prices.

Georgia Outlook

In 2024, Georgia's planted acreage decreased to 1.1 million acres, 10,000 acres less than in 2023, marking the fourth-lowest level of planted acreage in the past 30 years. The state's cotton production is estimated at 2 million bales, with an average yield of 881 lb per acre. Planted cotton acreage in Georgia is expected to remain relatively low in 2025.

2025 Price Outlook Summary

For cotton producers, 2025 could be yet another challenging year. Interest rates are expected to remain high for an extended period. Consumer spending on discretionary items is anticipated to tighten because of slow economic growth. Input costs will likely remain high, and cotton prices are expected to stay low. U.S. cotton acreage and production are projected to remain at current low levels in 2025, driven by relatively low price expectations and competition from other crops, such as peanuts and corn. As of December 12, 2024, December futures prices (CTZ25) for the 2025 cotton crop are around 71.17 cents per pound. The optimistic price range for cotton in 2025 is expected to be between 74 and 79 cents per pound, while the pessimistic price range for 2024 is projected to be between 66 and 69 cents per pound. For planning and budgeting purposes, a price range of 69 to 73 cents per pound is suggested for cotton in 2025.

Status and Revision History

In Review on Jan 15, 2025

Published on Jan 22, 2025