Main Takeaways

- The significantly high price received by peach producers was instrumental in maintaining a strong producer price index in the 2022–2023 crop season. The PPI is expected to stay strong in 2024.

- The favorable prices were a result of the production shortages caused by the extremely bad weather in the first quarter of 2023 that completely devastated the Georgia and South Carolina peach industries.

- Citrus experienced the lowest production recorded in the past five decades, and fresh market citrus is now the grower’s preference compared to processed.

- For blueberries, the newly signed memorandum to export 800 tons to the EU market would help maintain strong prices in the 2024 crop season.

Fruits and Tree Nuts

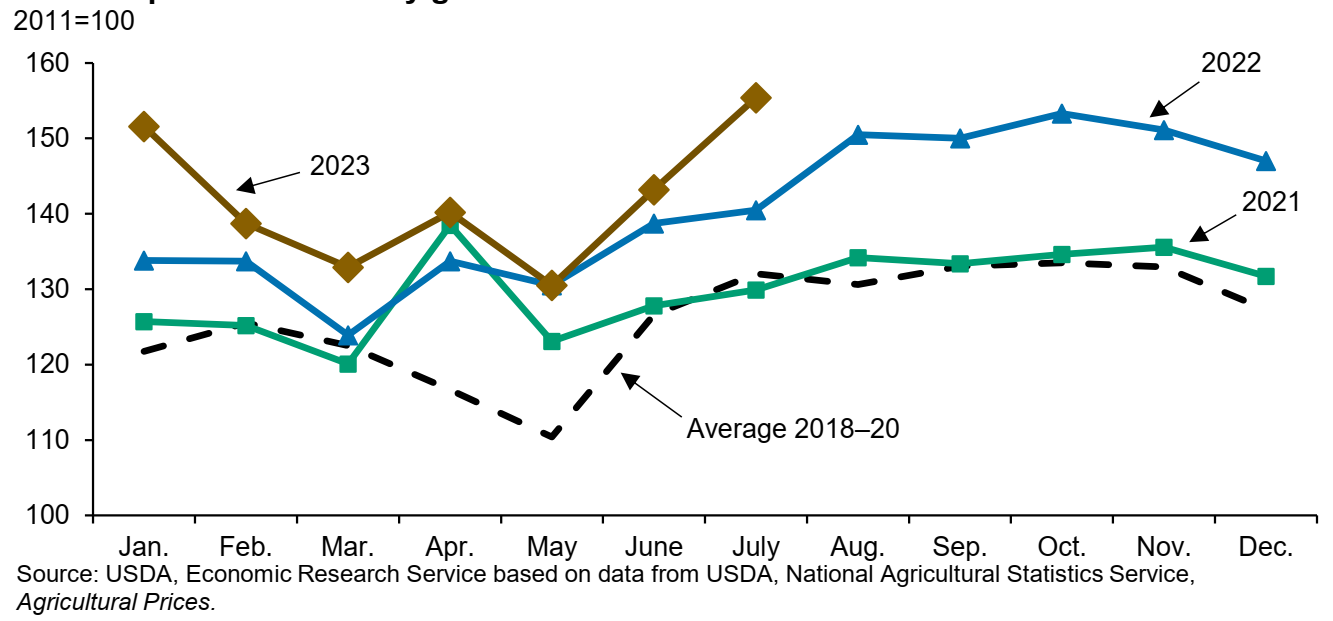

According to agricultural prices reported by the U.S. Department of Agriculture and Natural Agricultural Statistics Service, the producer price index (PPI) for fruit and tree nuts started relatively higher in 2022–2023 compared to the 2021–2022 crop season. The producer price index for fruit and tree nuts was 155.4 (2011=100) in January, trended down until March, fluctuated until May, and then spiked above the 2021–2022 mark and thereafter (Figure 1).

From the USDA Economic Research Service based on data from USDA National Agricultural Statistics Service.

The strong grower price index that triggered the spike in July 2023 was due to the increase in the prices of apples, grapes, peaches, pears, and strawberries. Although fresh and processed orange prices were relatively lower, it was not enough to affect the overall grower price index.

Peaches

The price for fresh peaches per pound was $0.90 in June 2022 compared to $1.28 in the same time period in 2023 (a 42.2 % increase). One month later, in July 2022, fresh peach prices increased to $0.94, whereas in 2023 the price slightly dropped from June ($1.28) to July ($1.21). However, despite the slight decrease in the 2023 July price, there still was a 28.7% increase compared to June 2023 (Table 1).

| Commodity | June | July | Year-to-year change | |||

|---|---|---|---|---|---|---|

| 2022 | 2023 | 2022 | 2023 | June | July | |

| Citrus fruit /1 | (dollars per box) | (percent) | ||||

| Grapefruit, all | 19.24 | 14.04 | 13.17 | 11.96 | -27 | -9.2 |

| Grapefruit, fresh | — | — | — | — | — | — |

| Lemons, all | 11.6 | 13.23 | 9.06 | 21.07 | 14.1 | 132.6 |

| Lemons, fresh | 22.54 | 27.23 | 22.74 | 28.53 | 20.8 | 25.5 |

| Oranges, all | 21.66 | 14.61 | 19.36 | 14.03 | -32.5 | -27.5 |

| Oranges, fresh | 30.46 | 20.82 | 28.31 | 17.69 | -31.6 | -37.5 |

| Noncitrus fruit /2 | (dollars per pound) | (percent) | ||||

| Apples, fresh | 0.72 | 0.838 | 0.69 | 0.864 | 16.4 | 25.2 |

| Grapes, fresh | 1.555 | 1.515 | 1.235 | 1.365 | -2.6 | 10.5 |

| Peaches, fresh | 0.9 | 1.28 | 0.94 | 1.21 | 42.2 | 28.7 |

| Pears, fresh | 0.605 | 0.69 | 0.725 | 0.735 | 14 | 1.4 |

| Strawberries, fresh | 0.906 | 1.2 | 1.24 | 1.48 | 32.5 | 19.4 |

| From “Fruit and Tree Nuts Outlook: September 2023” (Publication No. FTS-377) by C. Weber, S. Simnitt, S. Wechsler, and H. Wakefield, 2023, USDA Economic Research Service (https://www.ers.usda.gov/webdocs/outlooks/107540/fts-377.pdf). | ||||||

Favorable fresh peach prices can partially be attributed to the shortage and poor performance of the South Carolina and Georgia peach industries which were seriously hit with a combination of warm and cold fronts that completely wiped out the crop in the first quarter of 2023. For instance, South Carolina, the second-largest peach-producing state after California, suffered a 66% decrease in production, while Georgia, the third-largest peach-producing state, experienced a 78% decrease in production because of these unfavorable weather conditions. Despite the reduced fresh peach production in the Southeast, studies have shown that overall peach production may still be strong in 2024 as other states like Colorado, New Jersey, Pennsylvania, and Washington have all increased their production by 17%, 78%, 11%, and 3% respectively, thus capturing Georgia’s market share.

Citrus

According to NASS, U.S. citrus production in the 2022–2023 season was the lowest reported in the past five decades. Total production was 4.9 million tons in the 2022–2023 crop season, a decrease of 12% from the previous season. This persistent downward trend in citrus production has always been blamed on the Huanglongbing (HLB) disease, also known as citrus greening. However, it is worth mentioning that the state and University of Georgia have put in place measures to help prevent and slow the spread of HLB and other citrus diseases in Georgia. Georgia production acreage of citrus is around 1,677 acres.

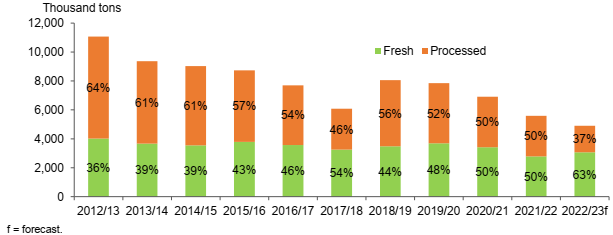

Historically, the market for processed citrus has always exceeded the fresh market except for a few exceptional crop seasons, but that trend changed in the 2022–2023 crop season where 63% went to the fresh market compared to 37% processed (Figure 2).

Blueberries

Despite the challenges faced by Georgia blueberry growers in terms of fluctuating prices and excess import supply from Canada, Chile, Mexico, and Peru, a new agreement with the European Union is welcome news for Georgia producers. The newly signed memorandum by the Georgia Blueberry Growers Association allows for the export of 800 tons (1.6 million lb), approximately 26% of total production of blueberries, to the EU market in the 2024 harvest season. It would help stabilize prices received by Georgia growers.

According to EastFruit (promotion and trade group), blueberry prices in EU markets range from $6–$7 per kilogram throughout the season, compared to Russian prices which fluctuate drastically from $14 per kilogram in the first 2 weeks of supplies to a bare $2–$3 per kilogram thereafter. A Geostat report showed that Georgia blueberry exports increased by 2.4 times in 2023 compared to previous years, with 3,270 tons sold to foreign countries.

Status and Revision History

In Review on Jan 19, 2024

Published on Jan 22, 2024